The Service Tax rate is fixed at 6 and the list of services subject to it include hotels insurance gaming legal and accounting services employment agencies parking couriers advertising and electricity. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat.

Comparing Sst Vs Gst What S The Difference Comparehero

The switch is expected to cost the country an estimated at RM25 billion in lost revenues as only a fracti.

. 1 Goods and Services Tax Repeal Act 2018. Sales and service tax SST has been doing well in Malaysia before it was replaced a few years back. It is replacing the 6 Goods and Services Tax suspended on 1 June 2018.

The sales tax is based on exclusion criteria where all things are taxed by default unless being exempted whereas the service tax is based on inclusion criteria meaning. Effective 1 September 2018 the Malaysian Government has replaced the Goods and Services Tax GST with Sales and Service Tax SST. Land outside Malaysia or where the subject matter relates to a country outside Malaysia RM500000 19.

Employment agency RM150000 Employment agency Employment services excluding 1. The Sales Tax is a single-stage tax charged and levied on taxable goods imported into Malaysia and on taxable goods manufactured in Malaysia by a taxable person and sold by him including used or disposed of goods. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline.

September is here and Malaysia has entered into the new period of the Sales and Services Tax SST. The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000. The SST is being introduced as a replacement of the Goods and Services Tax GST.

I The SST will be a single-stage tax where the sales ad. Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia. 2 Sales Tax Act 2018.

Here are the details on how the SST works - the registration process returns and payment of the SST and the transitional measures to take after the abolishment of the GST. Now that the implementation of SST has begun Malaysians are curious to see how prices have changed since 1 September. On taxable goods imported into Malaysia.

Amendment 12019 Sales Tax Determination Of Sale Value Of Taxable Goods Regulations 2018. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax. Service Tax Regulations Service Tax Regulations 2018.

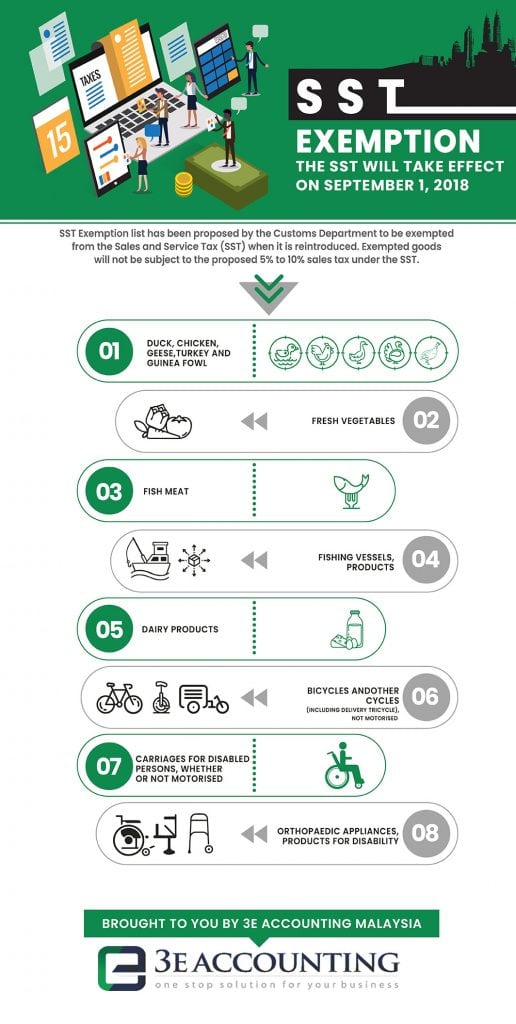

List Of SST Regulations. The Ministry of Finance MoF announced that Sales and Service Tax SST will come into effect in Malaysia on 1 September 2018. Malaysia has tabled at Parliament the implementation bill for its Sales and Service Tax SST which comes into force on 1 September 2018.

Service tax a consumption tax levied and. In Malaysia it is a mandatory requirement that all manufacturers of taxable goods are licensed under the Sales Tax Act 2018. Sales and Service Tax SST has replaced the Goods and Sales Tax GST on 1st September 2018 in Malaysia.

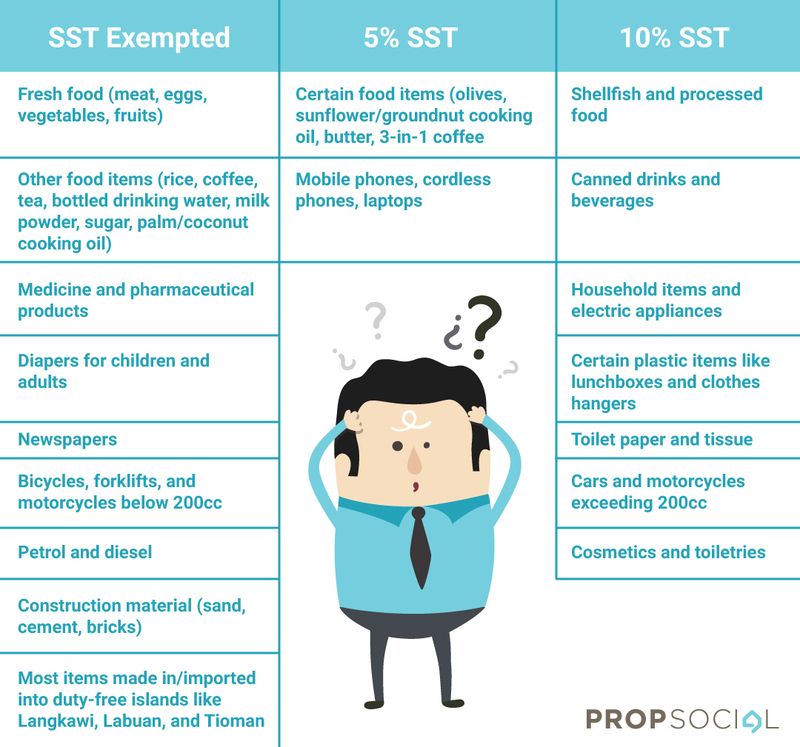

It stands for 10 percent for sales tax while service tax will be charged 6 percent according to the new release from the finance ministryThis new system has already become operational and it was to be in September 2018 which is a few months back. On taxable goods manufactured in Malaysia by a taxable person and sold by him including used or disposed off. SST consist of 2 separate act.

The move of scrapping the 6 GST has paved the way for the re-introduction of SST which will come into effect in 1 September 2018. Sales Tax Act and Service Tax Act. From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia.

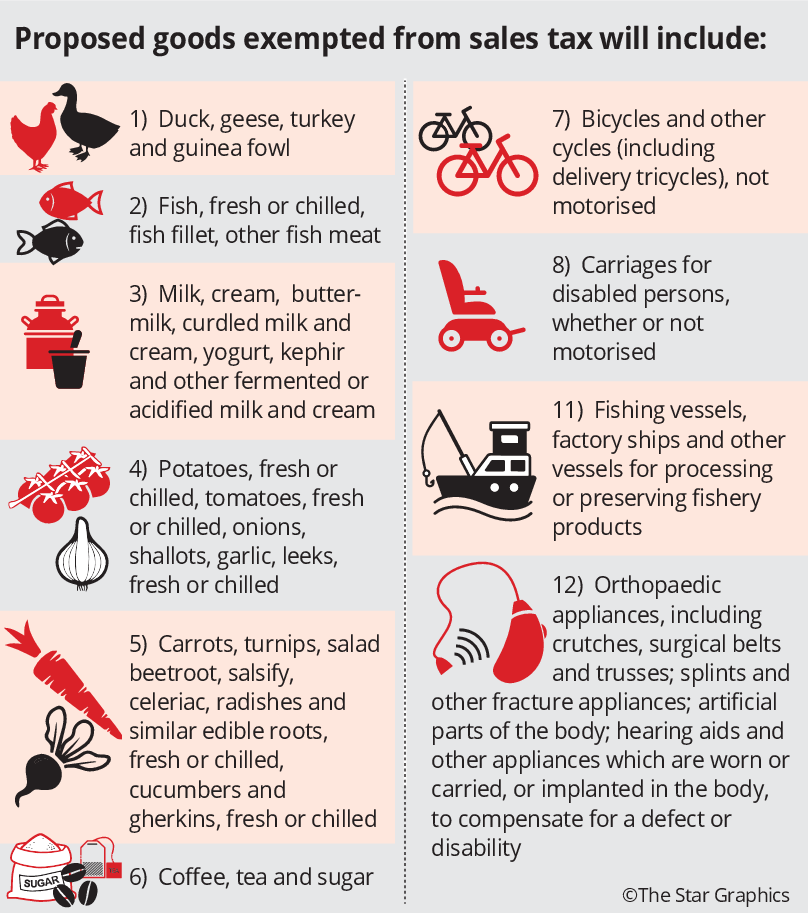

Sales and Services Tax Act 2018 Malaysia Dr Choong Kwai Fatt SST Royal Customs Malaysian Taxation Tax Planning Synergy TAS Kwai Fatt Sales Tax Seminar SST. Goods which are NOT listed under the Sales Tax Goods Exempted From Sales Tax Continue Reading Sales Services Tax 2018 SST 2018. Please click on the links below to access the relevant legislation.

Sst malaysia 2018 list Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perd. In this regard Bursa Malaysia Berhad and some of its subsidiaries have been registered for service tax purposes and will start charging 6 service tax on certain fees effective from 1 May 2019. Employment outside Malaysia RM500000 20.

To Members of the Malaysian Bar. Secondment of employees or supplying employees to work for another person for a period of time. Sales Tax Regulations Sales Tax Regulations 2018.

Implemented since September 2018 Sales and Service Tax SST has replaced Goods and Services Tax GST in MalaysiaThe SST consists of 2 elements. Jabatan Kastam Diraja Malaysia. Malaysia has re-introduced the Sales and Services Tax SST on September 1 2018.

Sales Tax 2018 Sales tax is a single-stage tax charged and levied. As you are aware the Goods and Services Tax GST Act 2014 has been repealed and the Sales and Services Tax SST legislation came into effect on 1 Sept 2018. This comes after the tax holiday when the previous Goods and Services Tax GST was zero-rated for the last three months.

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Essential Items Will Be Exempted From Sst

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Sst Mercedes Benz Price List 19 Models Up 6 Down Paultan Org

![]()

Mercedes Benz Malaysia Announces New Sst Price List While Glc Gets Safety Updates

Goods And Person Exempted From Sales Tax Sst Malaysia

Sst Simplified Malaysian Sales Tax Guide Mypf My

Sst Simplified Malaysian Sales Tax Guide Mypf My

Malaysia Sst Sales And Service Tax A Complete Guide

Welcome Back Sst So What S New Propsocial

How Is Malaysia Sst Different From Gst

Sst Nissan Price List Cheaper By Up To Rm5 400 Paultan Org

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions

Sst Simplified Malaysian Sales Tax Guide Mypf My

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Sst Simplified Malaysian Sales Tax Guide Mypf My

Sst Simplified Malaysian Service Tax Guide Mypf My